The global foreign exchange (Forex) market stands alone in its continuous operation, offering trading opportunities around the clock, five days a week. Unlike stock markets with defined opening and closing bells, the decentralised nature of Forex means that as one major financial centre concludes its business day, another is just beginning. Understanding these market hours and the distinct characteristics of each trading session is fundamental for any participant, from novice retail traders to seasoned institutional professionals. This guide provides a comprehensive overview of the global Forex trading sessions, their typical attributes, and how their overlaps can influence market dynamics.

The 24-Hour Forex Market

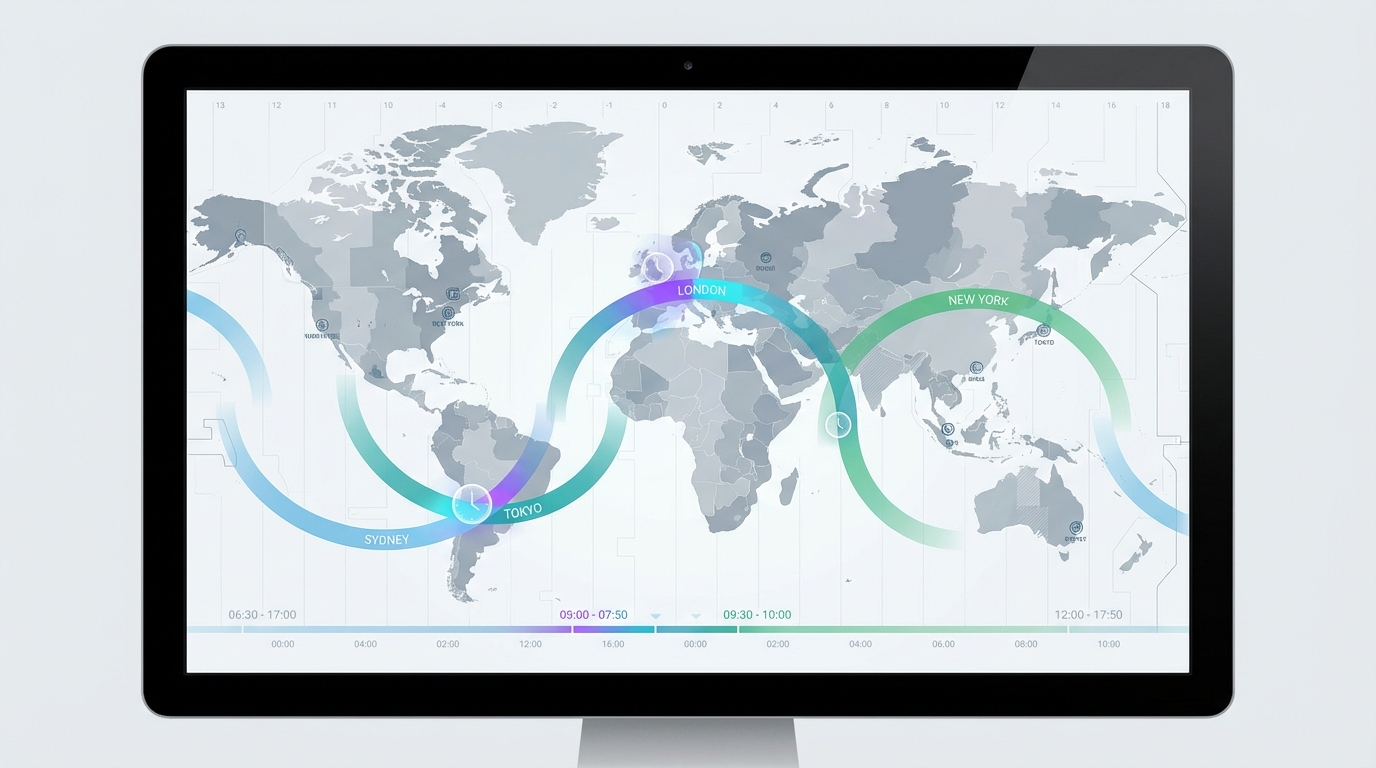

The concept of a 24-hour market is central to Forex trading. It operates continuously from Sunday evening GMT until Friday evening GMT, driven by a succession of major financial centres opening and closing across the globe. This continuous cycle ensures that traders in different time zones can participate when their local markets are active, facilitating constant liquidity and price discovery.

The market's structure is decentralised, meaning there is no single exchange. Instead, trading occurs over-the-counter (OTC) through a vast network of banks, financial institutions, and brokers worldwide. The constant hand-off from one major trading hub to another—Sydney, Tokyo, London, and New York being the primary ones—creates this unbroken flow of activity.

Key Takeaway: The Forex market's 24-hour nature is a result of major financial centres opening and closing sequentially across different time zones, ensuring continuous trading activity from Sunday evening to Friday evening UTC.

Sydney Session

The Sydney session marks the official start of the Forex trading week, as Monday dawns in Australia. While it is often the quietest of the major sessions in terms of trading volume, it sets the initial tone for the week's trading.

- Typical Hours (Approximate UTC): 22:00 - 07:00 UTC

- Key Characteristics:

- First to Open: Kicks off the trading week on Sunday evening UTC.

- Lower Liquidity: Compared to European and North American sessions, liquidity is generally lower, leading to potentially wider spreads for some currency pairs.

- Regional Focus: Primarily influenced by news and economic data from Australia and New Zealand.

- Precursor to Asia: Often sets the stage for the Tokyo session.

- Active Currencies: Australian Dollar (AUD) and New Zealand Dollar (NZD) pairs (e.g., AUD/USD, NZD/USD, AUD/JPY).

Traders during this session often monitor early week sentiment and any overnight news that might have developed over the weekend. While not known for dramatic movements, it can offer opportunities for those focused on commodity currencies or seeking to capitalise on early market reactions.

Tokyo Session

Following the Sydney session, the Tokyo session takes centre stage as the primary Asian trading hub. It brings increased liquidity and often sets the tone for Asian market sentiment.

- Typical Hours (Approximate UTC): 00:00 - 09:00 UTC

- Key Characteristics:

- Asian Hub: The most significant financial centre in Asia, driving much of the region's Forex activity.

- Increased Liquidity: Significantly more liquid than Sydney, with tighter spreads for many pairs, especially those involving the Japanese Yen.

- JPY Dominance: The Japanese Yen (JPY) is a major focus, with cross-currency pairs like EUR/JPY and AUD/JPY seeing considerable action.

- Economic Data: Influenced by economic data releases from Japan, China, Australia, and other Asian economies.

- Active Currencies: Japanese Yen (JPY) is paramount. Also active are Australian Dollar (AUD), New Zealand Dollar (NZD), Chinese Yuan (CNH), and Singapore Dollar (SGD) pairs.

The Tokyo session is often characterised by range-bound trading for some major pairs, particularly in the absence of significant news. However, JPY pairs can experience considerable volatility, especially during periods of risk aversion or when Japanese economic data is released.

London Session

Often considered the heart of the Forex market, the London session is the most active and liquid of all major trading periods. Its geographical location bridges the Asian and North American sessions, making it a pivotal time for global trading.

- Typical Hours (Approximate UTC): 07:00 - 16:00 UTC

- Key Characteristics:

- Highest Liquidity: London is the world's largest Forex trading centre, accounting for an estimated 30-40% of all daily Forex transactions. This leads to the tightest spreads and deepest liquidity across most currency pairs.

- High Volatility: The influx of European traders and major news releases often results in significant price movements and increased volatility.

- Major Currencies: All major currency pairs (EUR/USD, GBP/USD, USD/CHF, USD/JPY) are actively traded, along with various cross-currency pairs.

- Economic Data: Heavily influenced by economic data from the Eurozone, United Kingdom, and Switzerland.

- Active Currencies: Euro (EUR), British Pound (GBP), Swiss Franc (CHF), and their crosses, along with the US Dollar (USD) against these majors.

The London session is a prime time for many trading strategies due to the abundance of liquidity and volatility. Price trends often establish themselves during this period, and many significant market moves originate from London.

New York Session

The New York session is the second most active session and is particularly important due to the dominance of the US Dollar as the world's primary reserve currency. It overlaps significantly with the London session, creating a period of intense activity.

- Typical Hours (Approximate UTC): 12:00 - 21:00 UTC

- Key Characteristics:

- Second Highest Liquidity: While slightly less than London, the New York session still offers substantial liquidity, especially during its overlap with London.

- USD Focus: The US Dollar is involved in approximately 88% of all Forex transactions, making US economic data and events paramount during this session.

- Major News Releases: Many high-impact US economic data releases (e.g., Non-Farm Payrolls, CPI, FOMC announcements) occur during this session, causing significant market reactions.

- Commodity Currencies: Canadian Dollar (CAD) and other commodity-linked currencies often see increased activity.

- Active Currencies: US Dollar (USD) pairs (e.g., EUR/USD, GBP/USD, USD/JPY, USD/CAD), and other North American currencies.

The New York session often features continuations or reversals of trends established in London. The period where London and New York are both open is typically the most dynamic of the entire trading day.

Session Overlaps

The interaction between different trading sessions, known as session overlaps, is crucial for understanding market dynamics. These periods are often characterised by higher liquidity, increased volatility, and tighter spreads, presenting unique opportunities and challenges for traders.

London-New York Overlap

- Typical Hours (Approximate UTC): 12:00 - 16:00 UTC

- Significance: This is arguably the most important overlap, as it brings together two of the world's largest financial centres.

- Peak Liquidity: The sheer volume of participants from both Europe and North America ensures maximum liquidity, which can lead to tighter spreads and easier execution of trades.

- Highest Volatility: With a greater number of active traders and the release of major economic data from both regions, this period often sees the most significant price movements and volatility.

- Major News Impact: High-impact news from the US, UK, and Eurozone frequently occurs during this overlap, driving strong directional moves.

- Active Pairs: All major pairs, especially EUR/USD, GBP/USD, USD/CHF, and USD/CAD, experience heightened activity.

Key Takeaway: The London-New York overlap is the most active and volatile period in the Forex market, offering the deepest liquidity and significant trading opportunities.

Tokyo-London Overlap

- Typical Hours (Approximate UTC): 07:00 - 09:00 UTC

- Significance: This overlap sees the close of the Tokyo session and the beginning of the London session.

- Moderate Activity: While not as intense as the London-New York overlap, there's still a noticeable increase in activity as European traders enter the market while Asian traders are still active.

- Transition Period: Often marks a transition where Asian trends might consolidate or reverse as European sentiment takes over.

- Active Pairs: Pairs involving JPY, EUR, and GBP (e.g., EUR/JPY, GBP/JPY, EUR/GBP) often see increased movement.

Sydney-Tokyo Overlap

- Typical Hours (Approximate UTC): 00:00 - 07:00 UTC (partially overlaps, depending on the exact definitions)

- Significance: This overlap occurs early in the trading day, linking the Australian and Japanese markets.

- Lower Activity: Generally the least active of the major overlaps, with moderate liquidity.

- Regional Focus: Primarily driven by news and economic data from Australia, New Zealand, and Japan.

- Active Pairs: AUD/JPY, NZD/JPY, and other AUD/NZD crosses.

Best Times to Trade

While there isn't a universally "best" time to trade, as it largely depends on an individual's trading strategy, risk tolerance, and preferred currency pairs, certain periods offer conditions that are generally more conducive to active trading. Instead of specific recommendations, we can identify optimal conditions based on market characteristics:

- High Liquidity for Tighter Spreads: During periods of high liquidity, such as the major session overlaps (especially London-New York), spreads tend to be tighter. This can reduce trading costs and improve execution for all traders, particularly those employing high-frequency or scalping strategies.

- Increased Volatility for Price Movement: If your strategy thrives on price movement, periods of higher volatility, particularly during the London and New York sessions and their overlap, can offer more opportunities. Major economic data releases from the US, UK, and Eurozone typically occur during these times, leading to significant price swings.

- Targeting Specific Currency Pairs:

- For JPY pairs, the Tokyo session and its overlap with London are often ideal.

- For EUR, GBP, and CHF pairs, the London session is paramount.

- For USD and CAD pairs, the New York session, especially during its overlap with London, offers the most activity.

- Avoiding Low Liquidity: Conversely, periods of very low liquidity, such as the Sydney session (especially early in the week) or during major public holidays, can lead to wider spreads, choppy price action, and increased slippage. These times might be less suitable for active trading.

- News Trading: For traders who specialise in reacting to economic news, aligning trading with scheduled high-impact data releases is crucial. These often occur during the London and New York sessions. However, news trading carries inherent risks due to rapid and unpredictable price movements.

Ultimately, the "best" time to trade is when market conditions align with your specific trading plan and risk management principles. Understanding the characteristics of each session and overlap allows traders to make informed decisions about when to be active and when to observe.

Conclusion

Navigating the Forex market effectively requires a comprehensive understanding of its global operating hours. Each major trading session—Sydney, Tokyo, London, and New York—brings its unique characteristics, influencing liquidity, volatility, and the activity of specific currency pairs. Crucially, the overlaps between these sessions, particularly the London-New York overlap, represent periods of heightened activity and opportunity due to concentrated market participation.

By appreciating how these sessions unfold and interact, traders can strategically align their activities with periods that offer the most favourable conditions for their chosen strategies, whether that involves seeking high liquidity, capitalising on volatility, or focusing on particular currency pairs. This knowledge is not merely academic; it is a practical tool for optimising trading decisions and enhancing overall market engagement.

Risk Disclaimer: Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.