Why Risk Management Matters

Forex trading, while offering significant opportunities for capital growth, is inherently fraught with volatility and complexity. The global foreign exchange market is the largest and most liquid financial market in the world, with trillions of dollars exchanged daily. This immense scale means rapid price movements, influenced by a myriad of economic, political, and geopolitical factors. Without a robust framework for managing risk, traders expose their capital to substantial and potentially irreversible losses. The primary objective of risk management in forex trading is not to avoid losses entirely – losses are an inevitable part of trading – but rather to control their magnitude and frequency, thereby preserving trading capital and ensuring long-term sustainability. Statistics consistently show that a significant percentage of retail traders lose money, often due to inadequate risk management practices, emotional decision-making, and over-leveraging. A disciplined approach to risk management serves several critical functions:- Capital Preservation: This is paramount. The fundamental rule of trading is to protect your capital. If your capital is depleted, you can no longer trade.

- Emotional Control: Defined risk parameters help remove the emotional component from trading decisions, preventing impulsive actions driven by fear or greed.

- Longevity in the Market: By limiting losses, traders can withstand periods of unfavorable market conditions or a series of losing trades, allowing them to remain in the market long enough to capitalize on profitable opportunities.

- Consistent Performance: A sound risk management strategy contributes to more consistent equity growth over time, even if individual trade win rates are not exceptionally high.

Key Takeaway: Risk management is the bedrock of successful forex trading. It is not merely a supplementary practice but an indispensable component of any viable trading strategy, designed to safeguard capital and foster psychological resilience.

Position Sizing Strategies

Position sizing is perhaps the most critical aspect of risk management, determining the amount of capital allocated to a single trade. It directly impacts the potential loss a trader can incur and, consequently, the long-term viability of their trading account. Incorrect position sizing can quickly decimate an account, even with a high win rate.Fixed Percentage Model

This is the most widely recommended and prudent approach for retail and professional traders alike. It dictates that a trader risks only a predetermined percentage of their total trading capital on any single trade. Common percentages range from 1% to 2% per trade. Let's illustrate with an example:Suppose a trader has a trading account of $10,000. If they adopt a 1% risk rule, they are willing to risk a maximum of $100 per trade ($10,000 * 0.01).

If their stop-loss for a particular trade is 50 pips, and they are trading EUR/USD where 1 standard lot (100,000 units) has a pip value of $10, then to risk only $100:

- Risk per pip = $100 / 50 pips = $2 per pip

- Lot size = $2 per pip / ($10 per pip per standard lot) = 0.2 standard lots (or 2 mini lots, 20 micro lots).

Fixed Monetary Amount Model

Less common for larger accounts but sometimes used by newer traders with very small capital, this model involves risking a fixed dollar amount per trade, regardless of account size. While simple, it fails to adapt as the account grows or shrinks, making it less dynamic and potentially leading to over-leveraging on a smaller account or under-leveraging on a larger one.Volatility-Adjusted Sizing

This more sophisticated approach adjusts position size based on the current market volatility of the instrument being traded. The idea is to risk the same *amount* of capital (e.g., 1% of the account) but adjust the *number of units* traded so that the stop-loss distance naturally aligns with market conditions.For example, if the Average True Range (ATR) indicates high volatility, the stop-loss might be wider, requiring a smaller position size to maintain the 1% risk. Conversely, in low volatility, a tighter stop-loss might be appropriate, allowing for a larger position size while still adhering to the 1% risk rule.

This method often utilizes indicators like the Average True Range (ATR) to determine appropriate stop-loss placement, and then calculates position size based on that stop-loss distance and the fixed percentage risk rule.

Regardless of the method chosen, the core principle remains: never risk more than a small, predetermined percentage of your capital on any single trade. This is fundamental to avoiding ruin and fostering sustainable growth.

Stop-Loss Orders: Types and Placement

A stop-loss order is an instruction to your broker to automatically close a trade if the market price moves against your position to a predetermined level. It is the most fundamental tool for limiting potential losses on a trade and is a non-negotiable component of effective risk management.Importance of Stop-Loss Orders

- Loss Mitigation: Directly prevents catastrophic losses by capping the maximum downside exposure.

- Emotional Discipline: Removes the emotional element of deciding when to exit a losing trade, preventing "hope trading" or "revenge trading."

- Capital Protection: Ensures that a predefined portion of capital is preserved, allowing for future trading opportunities.

Types of Stop-Loss Orders

- Market Stop-Loss: The most common type. When the market price reaches the specified stop-loss level, it triggers a market order to close the position at the best available price. This can be subject to slippage during volatile market conditions, meaning the order might be filled at a price worse than the specified stop-loss.

- Trailing Stop-Loss: A dynamic stop-loss that automatically adjusts as the price moves in the trader's favor. It maintains a fixed distance (in pips or percentage) from the current market price. If the market moves against the position, the trailing stop remains fixed; if the market moves favorably, the stop-loss moves with it, locking in profits while still protecting against a reversal.

- Guaranteed Stop-Loss (GSLO): Offered by some brokers, a GSLO guarantees that the trade will be closed at the exact stop-loss price, regardless of market volatility or slippage. Brokers typically charge a wider spread or a small premium for this service, but it offers absolute certainty regarding maximum loss.

Strategic Placement of Stop-Loss Orders

The placement of a stop-loss order should never be arbitrary. It must be logical, based on market structure and volatility, and aligned with the overall trading strategy.- Technical Analysis Based:

- Support and Resistance Levels: A common strategy is to place a stop-loss just beyond a significant support level (for a long trade) or resistance level (for a short trade). If these levels are broken, it often signals a change in market sentiment.

- Trend Lines/Channels: For trend-following strategies, a stop-loss can be placed just outside a defined trend line or channel.

- Previous Highs/Lows: Placing stops beyond recent swing highs or lows, as these points often represent areas where market direction might reverse.

- Volatility Based:

- Average True Range (ATR): Using ATR, traders can place a stop-loss a multiple of the current ATR value away from their entry price. For example, a stop-loss placed 1.5 or 2 times the ATR away can account for the instrument's typical price fluctuations, preventing premature stops due to normal market noise.

- Time-Based: Less common in forex, but some strategies might employ a stop-loss if a trade hasn't moved in a favorable direction within a specific timeframe, indicating a lack of momentum.

Risk-Reward Ratio

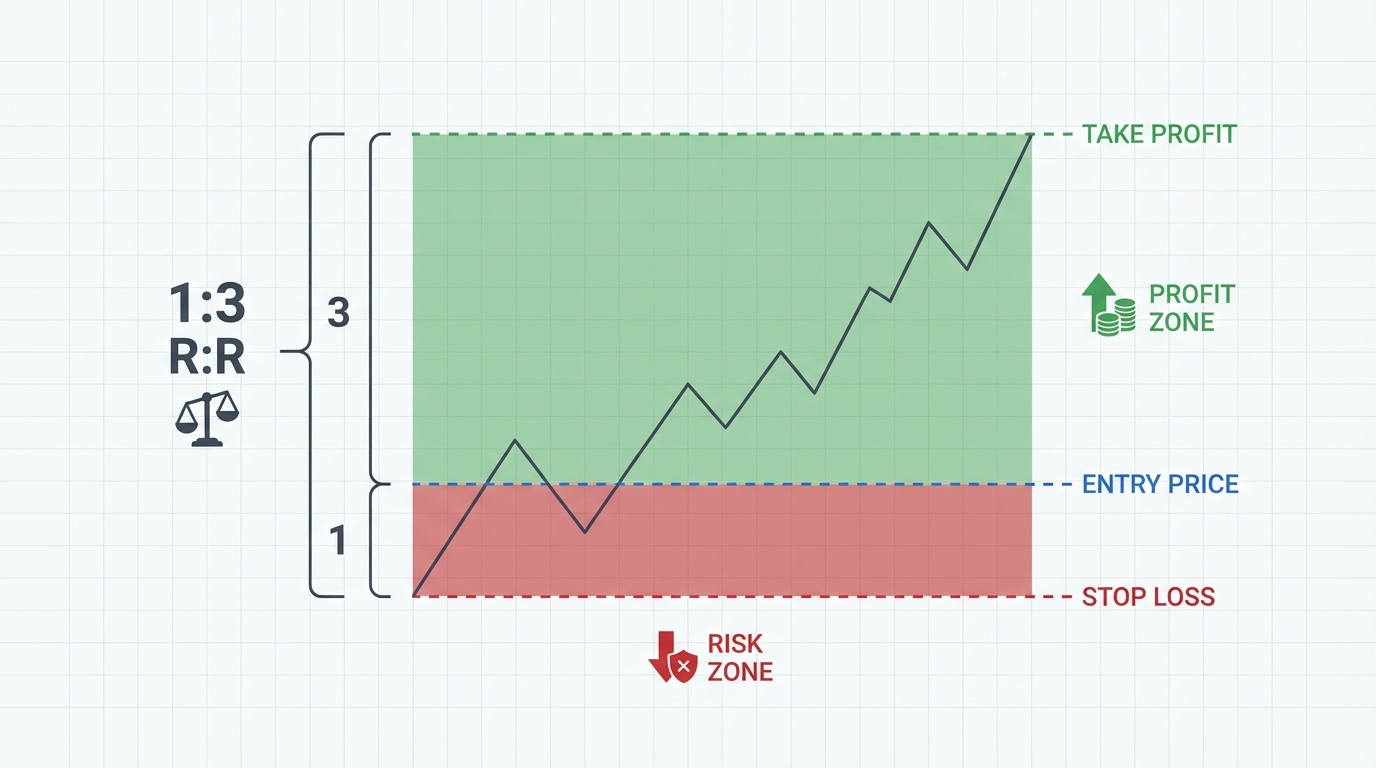

The Risk-Reward (R:R) ratio is a critical metric that measures the potential profit a trader expects to gain from a trade relative to the potential loss they are willing to risk. It is a powerful tool for evaluating the attractiveness of a trading opportunity and is integral to long-term profitability, especially when combined with a defined win rate.Calculating the Risk-Reward Ratio

The R:R ratio is calculated by dividing the potential profit (the distance from entry to target price) by the potential loss (the distance from entry to stop-loss price).For example, if you enter a long trade on EUR/USD at 1.1000, place a stop-loss at 1.0950 (50 pips risk), and set a take-profit target at 1.1150 (150 pips potential profit):

- Potential Risk = 50 pips

- Potential Reward = 150 pips

- Risk-Reward Ratio = 150 pips / 50 pips = 3. This is expressed as 1:3 (meaning for every 1 unit of risk, you aim for 3 units of reward).

Importance of the Risk-Reward Ratio

A favorable R:R ratio is essential because it allows a trader to be profitable even with a win rate below 50%.Consider two scenarios:

- Scenario A (1:1 Risk-Reward): If a trader aims for a 1:1 R:R, they need a win rate greater than 50% to be profitable (e.g., 60% win rate: 6 wins * $100 profit - 4 losses * $100 loss = $200 net profit).

- Scenario B (1:3 Risk-Reward): If a trader consistently aims for a 1:3 R:R, they can be profitable even with a significantly lower win rate. For instance, with a 30% win rate:

- 10 trades: 3 wins, 7 losses.

- 3 wins * $300 profit (assuming $100 risk) = $900

- 7 losses * $100 loss = $700

- Net Profit = $900 - $700 = $200

Practical Application

- Minimum R:R: Many experienced traders aim for a minimum R:R of 1:1.5 or 1:2. This provides a buffer against commissions, slippage, and unexpected market moves.

- Trade Selection: The R:R ratio helps filter out low-probability or unattractive trades. If a potential trade offers a poor R:R (e.g., 2:1 risk to reward, or 1:0.5), it might be best to pass on it, regardless of how strong the setup appears.

- Realistic Targets: While a high R:R (e.g., 1:10) might seem appealing, it must be realistic within current market conditions and price action. Unrealistic targets can lead to trades reversing before reaching profit, turning potential winners into losers.

Key Takeaway: A robust risk-reward ratio is a cornerstone of sustainable trading. It allows traders to manage their expectations and achieve profitability even without an exceptionally high win rate, provided they adhere to their predefined risk parameters.

Managing Drawdowns

A drawdown refers to the peak-to-trough decline in an investment account over a specific period. It represents the percentage loss from an account's equity high point to a subsequent low point before a new equity high is achieved. Managing drawdowns is crucial not only for capital preservation but also for maintaining psychological resilience.Understanding Drawdowns

Drawdowns are an inevitable part of trading. No strategy, regardless of its efficacy, can avoid periods of losing trades or underperformance. The depth and duration of a drawdown can significantly impact a trader's confidence and decision-making abilities. A 20% drawdown, for instance, requires a 25% gain to recover to the original equity peak. A 50% drawdown demands a 100% gain, highlighting the exponential difficulty of recovery from deep losses.Psychological Impact

Deep or prolonged drawdowns can trigger a range of negative emotions:- Fear: Leading to hesitation in taking valid setups.

- Frustration: Causing abandonment of a sound strategy.

- Revenge Trading: Impulsive, oversized trades to "get back" losses, often leading to deeper drawdowns.

- Loss of Confidence: Eroding belief in one's ability to trade profitably.

Strategies for Managing Drawdowns

Effective drawdown management involves both proactive measures and reactive responses:- Predefined Drawdown Limits: Establish maximum acceptable daily, weekly, or monthly drawdown percentages. For example, a trader might decide to stop trading for the day if their account drops by 3%, or take a week-long break if it drops by 10%. This acts as an emergency brake.

- Reducing Position Size: If a trader enters a drawdown phase, a prudent strategy is to reduce their standard position size (e.g., from 2% risk per trade to 1% or even 0.5%). This slows the rate of capital depletion and provides more time to adapt or recover.

- Taking a Break: Stepping away from the markets for a period can be incredibly beneficial. It allows for emotional reset, objective analysis of recent trades, and a refreshed perspective.

- Strategy Review and Adaptation: Use drawdowns as an opportunity to critically review the trading strategy. Are market conditions unfavorable for the current strategy? Are there fundamental flaws in the approach? This is not about abandoning a strategy prematurely but rather about identifying areas for refinement or temporary adjustment.

- Diversification: As discussed in the next section, diversifying across uncorrelated pairs or strategies can help smooth out equity curves and reduce the impact of a drawdown in any single area.

- Capital Allocation: Ensure that only risk capital – funds you can afford to lose without impacting your lifestyle – is used for trading. This reduces the psychological pressure associated with drawdowns.

Key Takeaway: Managing drawdowns is as much about managing your psychology as it is about managing your capital. By setting limits, adjusting exposure, and allowing for periods of reflection, traders can navigate inevitable losing streaks without succumbing to emotional pitfalls or permanent capital erosion.

Diversification in Forex

In traditional investment portfolios, diversification involves spreading investments across various asset classes (stocks, bonds, real estate, commodities) to reduce overall risk. While forex trading focuses on a single asset class (currencies), the principle of diversification still holds significant value, albeit applied differently. The goal remains the same: to reduce the overall risk profile of a trading portfolio and smooth out equity performance.Diversifying Across Currency Pairs

Trading only one or two currency pairs can concentrate risk. If those pairs enter a prolonged period of consolidation, high volatility, or simply don't align with a trader's strategy, performance can suffer. Diversifying across multiple currency pairs means:- Trading Uncorrelated Pairs: Not all currency pairs move independently. For instance, EUR/USD and GBP/USD often exhibit positive correlation due to their ties to the USD and the economic interconnectedness of the Eurozone and UK. Trading both simultaneously might not offer true diversification if they move in tandem. Instead, consider pairs with low or negative correlation, such as EUR/JPY, AUD/USD, or USD/CAD, to spread risk.

- Spreading Across Major, Minor, and Exotic Pairs: While major pairs (e.g., EUR/USD, USD/JPY) offer high liquidity, minor pairs (e.g., EUR/GBP, AUD/NZD) and exotic pairs (e.g., USD/ZAR, EUR/TRY) can present unique opportunities. However, caution is advised with exotics due to lower liquidity, wider spreads, and higher volatility.

- Avoiding Over-Diversification: Too many pairs can lead to diluted focus, increased monitoring effort, and potentially missed opportunities. A balanced approach involves selecting a manageable number of diverse pairs that align with one's analytical capabilities.

Diversifying Across Strategies and Timeframes

Beyond currency pairs, diversification can also extend to trading methodologies:- Combining Different Trading Strategies: A trader might employ a trend-following strategy on certain pairs or timeframes while simultaneously using a mean-reversion strategy on others. This can help balance performance, as different strategies perform optimally under varying market conditions. For example, a trend-following strategy might struggle in a choppy, range-bound market, while a mean-reversion strategy might thrive.

- Trading Multiple Timeframes: A trader might execute long-term swing trades on daily charts while also engaging in short-term day trades on hourly charts. This allows for capital to be deployed across different market cycles and provides exposure to various types of price action.

Correlation Management

Understanding currency correlation is key to effective diversification. Tools and indicators are available to measure the correlation between different currency pairs. A correlation coefficient close to +1 indicates a strong positive correlation (pairs move in the same direction), -1 indicates a strong negative correlation (pairs move in opposite directions), and 0 indicates no linear relationship. By judiciously selecting pairs with low or negative correlations, traders can reduce the likelihood of multiple positions moving against them simultaneously.Key Takeaway: While the concept differs from traditional asset diversification, applying diversification principles in forex by strategically selecting uncorrelated currency pairs and potentially employing varied trading strategies across different timeframes can significantly reduce overall portfolio risk and foster more stable equity growth.

Creating a Risk Management Plan

A comprehensive risk management plan is the final, unifying element that brings all individual risk control measures together into a structured, actionable framework. It is a documented set of rules and guidelines that dictates how a trader will approach risk in every aspect of their trading activities. This plan serves as a blueprint for disciplined decision-making, minimizing emotional interference and maximizing the chances of long-term success.Essential Components of a Risk Management Plan

Every robust plan should address the following critical areas:- Define Risk Tolerance:

- Clearly state the maximum percentage of capital you are comfortable losing on a single trade (e.g., 1% or 2%).

- Specify your overall acceptable drawdown limits (e.g., 5% daily, 15% monthly, at which point you stop trading and reassess).

- Position Sizing Methodology:

- Detail how you will calculate your position size for each trade (e.g., fixed percentage of account equity based on stop-loss distance, volatility-adjusted sizing).

- Provide a clear example of how this calculation is performed.

- Stop-Loss Strategy:

- Outline your rules for stop-loss placement (e.g., always beyond a significant support/resistance level, a multiple of ATR from entry).

- Specify whether you will use market, trailing, or guaranteed stop-losses and under what conditions.

- Emphasize that a stop-loss is mandatory for every trade.

- Risk-Reward Ratio Guidelines:

- Define the minimum acceptable risk-reward ratio for taking a trade (e.g., never less than 1:1.5).

- Explain how you will determine your profit targets in conjunction with your stop-loss.

- Drawdown Management Protocols:

- State the specific actions you will take if your account hits predefined drawdown limits (e.g., reduce position size, take a break from trading, perform a strategy review).

- Include psychological strategies for coping with losing streaks.

- Diversification Rules (if applicable):

- Specify how you will diversify across currency pairs (e.g., avoid highly correlated pairs).

- Mention if you will diversify across different strategies or timeframes.

- Trade Entry and Exit Criteria:

- While primarily part of a trading plan, risk management dictates that clear entry and exit rules are in place to prevent impulsive decisions.

- Define rules for scaling into or out of positions if that is part of your strategy, and how risk is managed during these phases.

- Review and Adaptation:

- Commit to regularly reviewing your risk management plan (e.g., monthly, quarterly) and adapting it as your account size changes, market conditions evolve, or your trading experience grows.

The Importance of Documentation and Discipline

A risk management plan is only effective if it is written down and strictly adhered to. It should be a living document, accessible and frequently referenced. The greatest plan is useless without the discipline to follow it, especially during periods of stress or excitement. By codifying your approach to risk, you establish an objective framework that guides your actions, mitigates emotional pitfalls, and ultimately protects your most valuable asset: your trading capital.***

Disclaimer: Forex trading involves significant risk to your capital. Losses can exceed deposits. This article is for educational purposes only and does not constitute financial advice or a recommendation to trade. You should not invest money that you cannot afford to lose. Seek independent advice if you have any doubts.